Automatic Break Removal with Smart Formulas

Automatic Break Removal with Smart Formulas

Overview

Break Formulas are a type of Smart Formula that automatically deducts break time from timesheet entries based on the number of hours worked. This feature supports two types of break deductions:

- SHIFTBRK: Deducts breaks from individual shifts

- DAYBRK: Deducts breaks from the total hours worked in a day

When you refresh your Smart Formulas from Xero, any employee with a break formula on their pay template will automatically have a syntax record created.

Formula Format

Break formulas follow this specific format:

NUMBER NAME [PERIOD][MIN~MAX][BREAK_LENGTH][BREAK_TYPE]

Formula Components

| Component | Description | Required | Examples |

|---|---|---|---|

NUMBER |

Numeric identifier for the pay item | Yes | use 010 |

NAME |

Descriptive text for the pay item | Yes | Break Deduction, Meal Break, Rest Break |

PERIOD |

When the formula applies | Yes | WEEKDAY, EVERY, MON, TUE, SAT, SUN |

MIN~MAX |

Hour range for break to apply (use ~ separator) |

Yes | 4~8, 6~12, 0~24 |

BREAK_LENGTH |

Minutes to deduct | Yes | 30, 45, 60 |

BREAK_TYPE |

Type of break deduction | Yes | SHIFTBRK or DAYBRK |

Break Types

SHIFTBRK (Shift Break)

Deducts the break from each individual shift when the shift hours fall within the specified range.

How it works:

- Calculates total hours for a single shift (same line number)

- If total shift hours are greater than

MINand less thanMAXfor the defined period, the break is deducted - Break is deducted from the latest sub-line first, then earlier sub-lines if needed

- Shift total cannot go negative

Example:

- Formula:

010 Break Deduction [WEEKDAY][4~8][30][SHIFTBRK] - A 5-hour shift on Monday: 30 minutes (0.5 hours) is deducted

- A 3-hour shift on Monday: No deduction (below minimum)

- A 9-hour shift on Monday: No deduction (above maximum)

DAYBRK (Day Break)

Deducts the break from total hours worked in the day across all shifts.

How it works:

- Calculates total hours from all sub-lines for the entire day

- If total day hours are greater than

MINand less thanMAXfor the defined period, the break is deducted - Break is deducted from the highest line number first, then the highest sub-line within that line (e.g., 6.1, then 5.2, then 5.1)

- Day total cannot go negative

Example:

- Formula:

020 Daily Break [WEEKDAY][6~12][45][DAYBRK] - Monday: 4 hours in morning + 4 hours in afternoon = 8 hours total

- Result: 45 minutes (0.75 hours) deducted from the latest shift

- Monday: 2 hours + 2 hours + 3 hours = 7 hours total

- Result: 45 minutes deducted, starting from the highest line number

Setup Instructions

Step 1: Create the Pay Item in Xero

A Pay Item is used to configure break parameters, but it will never appear on a payslip. No payslip lines are generated from this pay item; it exists solely as a way to configure and assign the rule to employees, providing complete flexibility.

- Log into your Xero account

- Navigate to Payroll → Pay Items → Earnings Rates

- Click Add to create a new earnings rate

- Enter the following:

- Name: Use the full formula format (e.g.,

010 Break Deduction [WEEKDAY][4~8][30][SHIFTBRK]) - Rate Type: Select

Multiple(or as appropriate for your setup) - Multiple: Set to

1(breaks don't add pay, they deduct time) - Unit Type:

Hours

- Name: Use the full formula format (e.g.,

Step 2: Add to Employee Pay Template

- Go to Payroll → Employees

- Select the employee

- Click on Pay Template

- Add the break formula pay item to their earnings

- Save the changes

Step 3: Refresh Smart Formulas in UpSheets

- Log into UpSheets

- Navigate to Smart Formulas

- Click Refresh Smart Formulas from Xero

- Wait for the refresh to complete

- The break formula will now be active for that employee

Examples

Example 1: 30-Minute Break for 4-8 Hour Shifts (Weekdays Only)

Formula:

010 Meal Break [WEEKDAY][4~8][30][SHIFTBRK]

Breakdown:

010: Pay item numberMeal Break: Descriptive nameWEEKDAY: Applies Monday through Friday4~8: Applies to shifts between 4 and 8 hours30: Deducts 30 minutesSHIFTBRK: Applied per shift

Results:

| Shift Hours | Day | Break Deducted | Final Hours |

|---|---|---|---|

| 3 hours | Monday | 0 minutes | 3.0 hours |

| 5 hours | Monday | 30 minutes | 4.5 hours |

| 7 hours | Monday | 30 minutes | 6.5 hours |

| 9 hours | Monday | 0 minutes | 9.0 hours |

| 5 hours | Saturday | 0 minutes | 5.0 hours |

Example 2: 45-Minute Break for 6-12 Hour Days (Every Day)

Formula:

020 Daily Rest Break [EVERY][6~12][45][DAYBRK]

Breakdown:

020: Pay item numberDaily Rest Break: Descriptive nameEVERY: Applies every day of the week6~12: Applies when total day hours are between 6 and 1245: Deducts 45 minutesDAYBRK: Applied to total day hours

Results:

| Morning Hours | Afternoon Hours | Total Day Hours | Break Deducted | Final Total |

|---|---|---|---|---|

| 4 hours | 4 hours | 8 hours | 45 minutes | 7.25 hours |

| 2 hours | 2 hours | 4 hours | 0 minutes | 4.0 hours |

| 3 hours | 3 hours | 6 hours | 45 minutes | 5.25 hours |

| 4 hours | 4 hours | 8 hours | 45 minutes | 7.25 hours |

| 6 hours | 6 hours | 12 hours | 0 minutes | 12.0 hours |

Example 3: 60-Minute Break for Long Shifts (Weekends Only)

Formula:

030 Weekend Break [SAT][6~10][60][SHIFTBRK]

Breakdown:

030: Pay item numberWeekend Break: Descriptive nameSAT: Applies only on Saturdays6~10: Applies to shifts between 6 and 10 hours60: Deducts 60 minutes (1 hour)SHIFTBRK: Applied per shift

Results:

| Shift Hours | Day | Break Deducted | Final Hours |

|---|---|---|---|

| 8 hours | Saturday | 60 minutes | 7.0 hours |

| 8 hours | Monday | 0 minutes | 8.0 hours |

| 5 hours | Saturday | 0 minutes | 5.0 hours |

| 11 hours | Saturday | 0 minutes | 11.0 hours |

Example 4: Multiple Breaks (Shift and Day)

You can have both SHIFTBRK and DAYBRK formulas active simultaneously:

Formulas:

010 Shift Break [WEEKDAY][4~8][30][SHIFTBRK]- 30 min per shift020 Day Break [WEEKDAY][8~12][45][DAYBRK]- 45 min for long days

Scenario: Employee works 5 hours in morning and 4 hours in afternoon (9 hours total)

Results:

- Morning shift (5 hours): 30 minutes deducted (SHIFTBRK applies)

- Afternoon shift (4 hours): 30 minutes deducted (SHIFTBRK applies)

- Total day (9 hours): 45 minutes deducted (DAYBRK applies)

- Total deductions: 30 + 30 + 45 = 105 minutes (1.75 hours)

- Final total: 9.0 - 1.75 = 7.25 hours

Period Options

| Period | Description | Days Included |

|---|---|---|

WEEKDAY |

Monday through Friday | Mon, Tue, Wed, Thu, Fri |

EVERY |

Every day of the week | All 7 days |

MON |

Monday only | Monday |

TUE |

Tuesday only | Tuesday |

WED |

Wednesday only | Wednesday |

THU |

Thursday only | Thursday |

FRI |

Friday only | Friday |

SAT |

Saturday only | Saturday |

SUN |

Sunday only | Sunday |

WEEKEND |

Saturday and Sunday | Sat, Sun |

Important Notes

Break Deduction Rules

-

Sub-lines Only: Breaks are only deducted from sub-lines

-

Deduction Order:

- SHIFTBRK: Deducted from latest sub-line first, then earlier sub-lines

- DAYBRK: Deducted from highest line number first, then highest sub-line within that line

-

Range Matching:

- Hours must be greater than

MINand less thanMAX(not equal to MAX) - Example:

[4~8]applies to shifts > 4 hours and < 8 hours (so 4.1 to 7.9 hours)

- Hours must be greater than

-

Period Matching: The

PERIODmust match the day of the week for the break to apply -

No Negative Hours: The system ensures that break deductions cannot result in negative hours

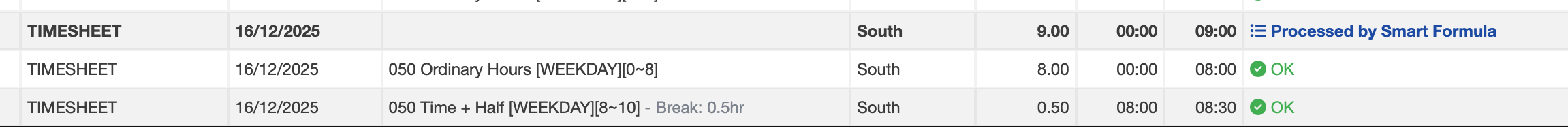

-

Break Display: Deducted breaks are displayed alongside the lines they are removed from for confirmation.

Best Practices

-

Use Descriptive Names: Choose clear names that indicate the purpose (e.g., "Meal Break", "Rest Break")

-

Set Appropriate Ranges: Ensure your MIN~MAX ranges don't overlap unnecessarily with other break formulas

-

Test First: Test break formulas with a small group of employees before rolling out to all employees

-

Monitor Results: After implementing, review timesheets to ensure breaks are being deducted correctly

-

Document Your Setup: Keep a record of which break formulas are active and for which employees

Troubleshooting

Break Not Being Deducted

Check:

- Is the formula correctly formatted in Xero?

- Have you refreshed Smart Formulas in UpSheets?

- Does the employee have the pay item on their pay template?

- Are the hours within the MIN~MAX range?

- Does the PERIOD match the day of the week?

- Are there sub-lines created for the timesheet? (Breaks only apply to sub-lines)

Break Deducted from Wrong Lines

Remember:

- SHIFTBRK applies to individual shifts (same line number)

- DAYBRK applies to total day hours across all shifts

- Breaks are always deducted from sub-lines, never main lines

Multiple Breaks Not Working

Check:

- Each break formula must have a unique NUMBER

- Ensure ranges don't conflict in unexpected ways

- Review the total deductions to ensure they're reasonable

Formula Format Reference

┌─────────────────────────────────────────────────────────────────┐

│ NUMBER NAME [PERIOD][MIN~MAX][BREAK_LENGTH][BREAK_TYPE] │

│ │

│ Example: │

│ 010 Meal Break [WEEKDAY][4~8][30][SHIFTBRK] │

│ │

│ Components: │

│ • NUMBER: 010 │

│ • NAME: Meal Break │

│ • PERIOD: WEEKDAY │

│ • MIN~MAX: 4~8 │

│ • BREAK_LENGTH: 30 (minutes) │

│ • BREAK_TYPE: SHIFTBRK │

└─────────────────────────────────────────────────────────────────┘

Support

For additional help or questions about Break Formulas:

- Review your Smart Formulas in the UpSheets dashboard

- Check that formulas are correctly formatted in Xero

- Ensure employees have the pay items assigned to their pay templates

- Contact support if you encounter unexpected behavior

Note: Break Formulas are part of the Smart Formulas feature. Smart Formulas are not a substitute for payroll or legal advice, nor are they intended to relieve you of your obligation to comply with the Legal Requirements applicable to your business. It is each customer's sole responsibility to pay its employees correctly and in compliance with all Legal Requirements.