File Formats for Timesheets, Leave and Adjustments (Australia)

Overview

UpSheets allows you to upload the following transactions to Xero:

- Timesheets

- Leave (Approved)

- Adjustments (Payslips)

- Earnings

- Reimbursements

- Deductions

- Leave Accruals

Alternative Formats

This document describes the requirements with a single row for each employee/date/type/hours. A common alternative format contains multiple columns for each type (pay item/earnings rate). These can be imported directly by configuring your pay items.

You may include any/all of the supported transaction types in the same file. You just need to provide correct data in appropriate columns and select them when uploading. See File Formats for Combined Timesheets, Leave and Adjustments in a single file (Australia) for examples.

Selecting Options

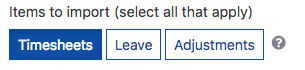

After connecting to Xero, select the appropriate options on the Import CSV File screen:

Notes on file formats

- Clicking the Download Sample button on the Import screen will download a file with your Xero data in it and is the easiest way to get started.

- A header row is not required, but it will save you time as UpSheets matches the headings automatically where possible and saves you from selecting them individually.

- The order of the columns in your file does not matter.

- Extra columns will be ignored, but it is faster if they are removed.

PLEASE NOTE - IN ALL OF THE EXAMPLES, YOU MAY USE A SINGLE 'FULL_NAME' FIELD INSTEAD OF 'FIRST_NAME/LAST_NAME'

Timesheets

| Heading | Description | Format | Notes |

|---|---|---|---|

| first_name | The first name of the employee. | Text | Required |

| last_name | The last name of the employee. | Text | Required |

| date | The date the employee worked. | Date | Required |

| hours | The number of hours the employee worked. | Number (max 2DP) | Required - You may optionally provide a Start Time and End Time column instead |

| type | The Earnings Rate for the hours worked. Must match the text of the Earnings Rate in Xero. | Text | Optional, but if not in the file a default or the employee default must be selected at import or by using multiple pay items. |

| tracking_code | The Tracking Code for the hours worked. Must match the text of the Tracking Code in Xero. | Text | Optional, but if not in the file a default must be selected at import. |

Leave

| Heading | Description | Format | Notes |

|---|---|---|---|

| first_name | The first name of the employee. | Text | Required |

| last_name | The last name of the employee. | Text | Required |

| date | The date the leave started. | Date | Required |

| end_date | The date the leave ended. | Date | Required |

| hours | The number of hours leave for the employee. | Number (max 2DP) | Required You may optionally provide a Start Time and End Time column instead |

| type | The type of leave taken. Must match the text of the Leave Type in Xero. | Text | Required (or use multiple pay items). |

| description | A description of the leave taken. | Text | Required |

Adjustments

| Heading | Description | Format | Notes |

|---|---|---|---|

| first_name | The first name of the employee. | Text | Required |

| last_name | The last name of the employee. | Text | Required |

| date | The transaction date. The specific date is not assigned in Xero, but it is used to allocate it to the correct period. | Date | Required |

| hours | The number of hours to be adjusted. | Number (max 2DP) | Required - See below - You may optionally provide a Start Time and End Time column instead |

| type | The type of adjustment. Must match the text of an active Pay Item defined in Xero. | Text | Required |

| calculation_type | The method used to calculate the total amount of the transaction. | Text | Required - See below |

| rate | The amount or rate of the transaction. The calculation type determines how this is used. | Number (max 2DP) | Required - See below |

| hours | The number of hours for the transaction. The calculation type determines how this is used. | Number (max 2DP) | Required - See below |

| description | A description of the reimbursement that will appear on the payslip. Used for reimbursements only | Text | Optional |

Calculation Type, Rate and Hours for Adjustment Types

The fields values that required in an upload file depend on the type of adjustment being uploaded as described in the table below.

All adjustments require the same file format and ALL fields must be included in the file, even if left blank. This enables you to upload multiple adjustment types in a single file and process them at once.

For example, the Hours column is required even when loading a deduction or reimbursement but the value should be left blank as per the table below. Likewise, Earnings still require the Calculation Type column, even though the value would be left blank.

| Adjustment Type | Calculation Type | Rate | Hours |

|---|---|---|---|

| DEDUCTION | PRETAX | The percentage of Pre Tax earnings to be deducted. Value must be between 0 - 100 | Leave blank |

| POSTTAX | The percentage of Post Tax earnings to be deducted. Note: This will cause an upload to fail if used with a type that reduces super or tax liability. Value must be between 0 - 100 | Leave blank | |

| FIXEDAMOUNT | The total amount to be deducted in dollars. Value must be between greater than 0 | Leave blank | |

| REIMBURSEMENT | FIXEDAMOUNT | The total amount to be reimbursed in dollars | Leave blank |

| EARNINGS | LEAVE BLANK - The Calculation Type uses the Pay Item Type defined in Xero and does not require a value in the upload file. | ||

| For types of Fixed Amount | The total amount in dollars | Leave blank | |

| For types of Rate per Unit OR Multiple | The rate per unit earnings OR LEAVE BLANK If a Rate Per Unit value is set in Xero. | The number of units worked | |

| LEAVE ACCRUAL | FIXEDHOURS | Leave blank | The number of hours to be accrued. |

| AUTO The calculation will be made by Xero automatically based on payslip/employee data | Leave blank | Leave blank |

PLEASE NOTE - IN ALL OF THE EXAMPLES, YOU MAY USE A SINGLE 'FULL_NAME' FIELD INSTEAD OF 'FIRST_NAME/LAST_NAME'

You may optionally provide a Start Time and End Time column instead of a single Hours column

For information on saving spreadsheets as CSV files see here